qa2qwas

Daily Stock Market Recap: 11/6

It’s Evan from @StockMKTNewz. Every day I cut through the noise to bring you the easiest and fastest way to get the news that really matters: the top headlines, the movers, and the market shifts you can’t afford to miss.

Here’s what you need to know today ⬇️

Here’s a quick recap of how the stock market performed today

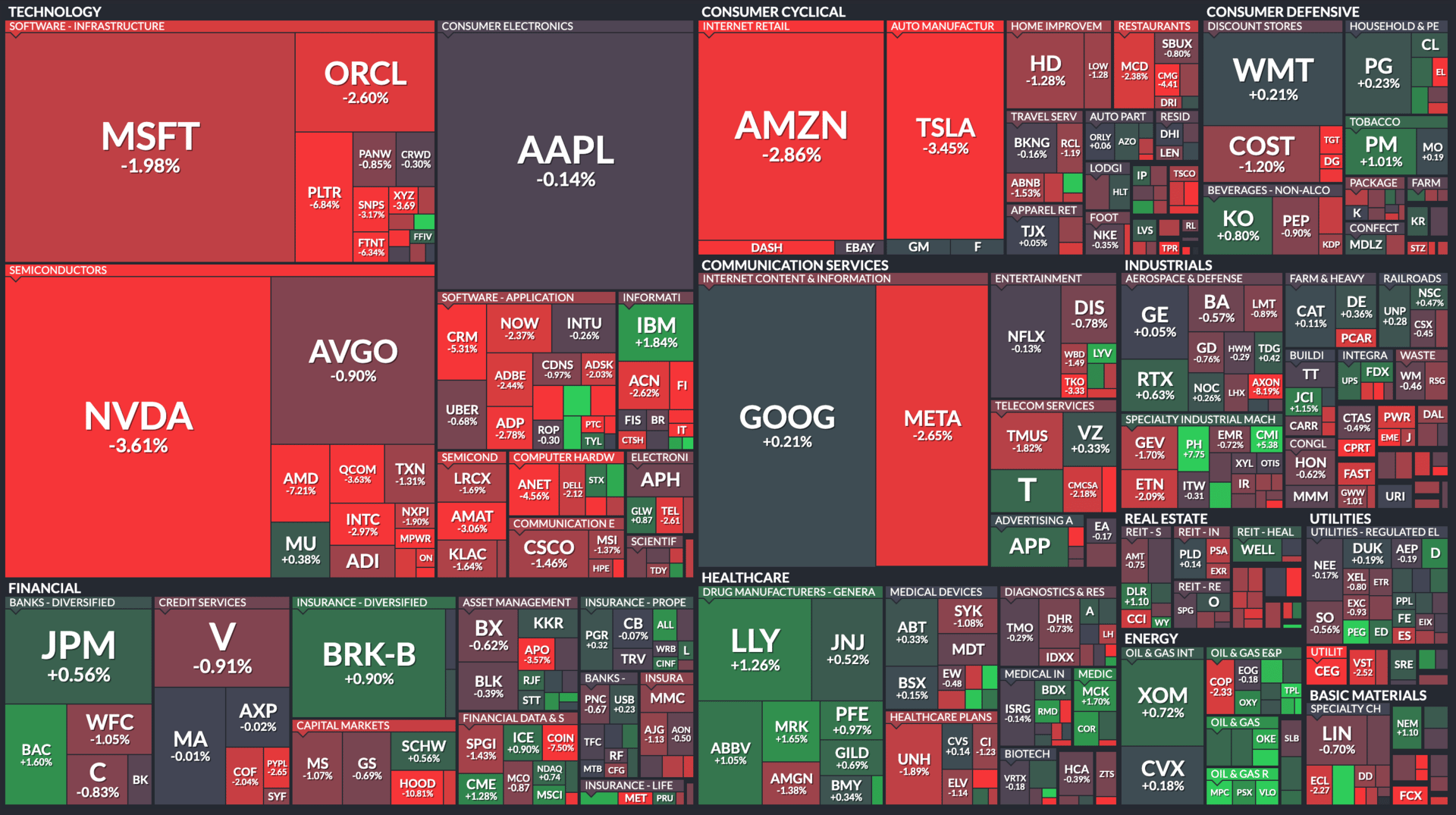

Heat Map of the S&P 500

Here’s how the major United States indices performed today

Here are the Best and Worst Performing S&P 500 Stocks from today

The Daily Recap

Here are the biggest news stories from the stock market today

Get Ready For Tomorrow

EARNINGS SEASON IS BACK

Earnings Hub: This is the earnings calendar I rely on daily during earnings season. Make your earnings season much easier by checking out Earnings Hub

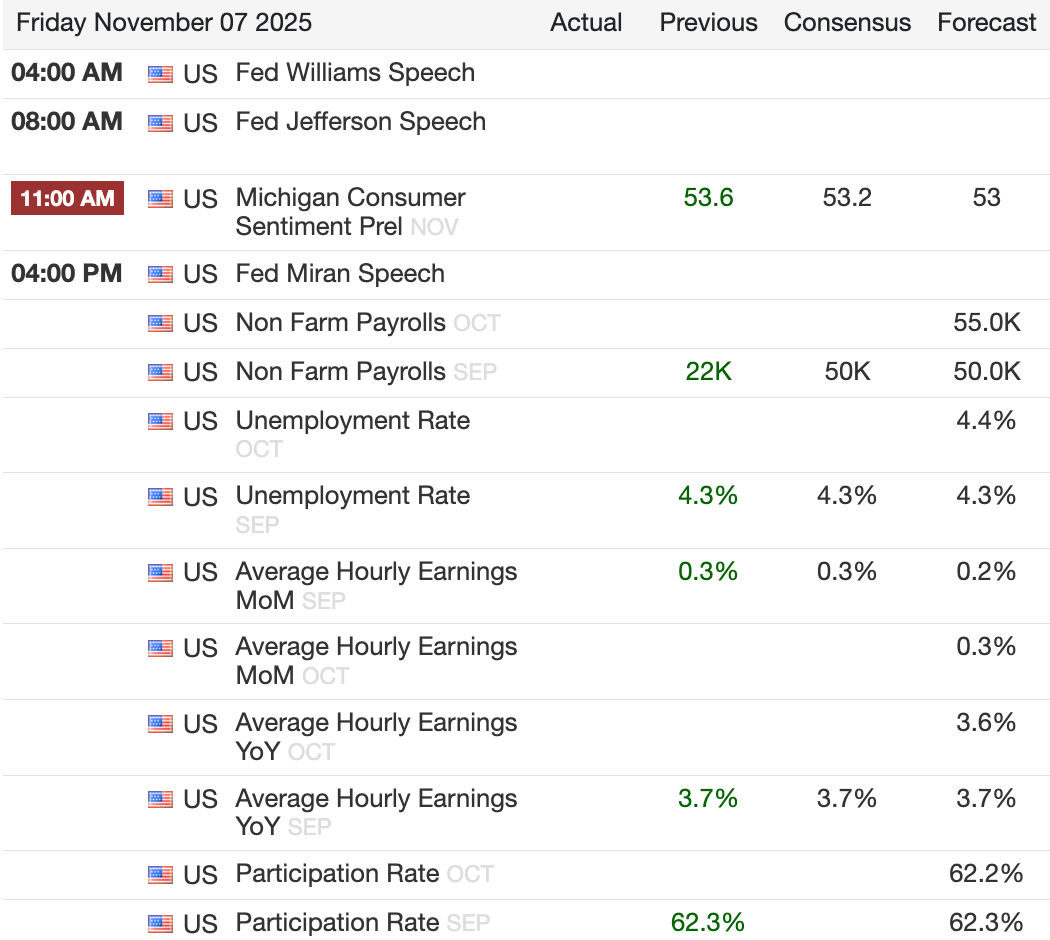

Macro Calendar:

Catalyst Watch:

RECENT ETF LAUNCH OF THE WEEK

Leverage Shares recently launched a new ETF the 2x Long BMNR Daily ETF $BMNG ( ▼ 3.93% )

It gives traders 2x daily exposure to $BMNR ( ▼ 2.06% )’s performance and aims to magnify short-term results without the risk of margin calls. It rebalances daily and carries a 0.75% expense ratio.

Since launching recently, it’s already seen strong trading activity … more than 250K shares traded today

Check out the ETF here

As always, this is not financial advice. My goal is just to put new products on your radar so you can do your own research and see if it’s something right for you. Leverage Shares is a WOLF Financial partner. Always do your own research!

Disclaimer:

The information provided in this publication is for informational and educational purposes only and should not be construed as financial, investment, or trading advice. The mention of any ETF, stock, or financial product is not an endorsement or recommendation to buy, sell, or hold.

Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a licensed financial professional before making any investment decisions.

Leverage Shares is a WOLF Financial partner. Investing in leveraged products involves significant risk. Leverage Shares ETFs seek daily leveraged exposure to underlying stocks or indexes, which can amplify both gains and losses. Because of daily rebalancing and compounding, performance over periods longer than one day will differ from the targeted return and may result in significant losses, even if the underlying stock increases in value.

Investors should carefully review each fund’s objectives, risks, and expenses before investing. Prospectuses and additional information are available at leverageshares.com

Leverage Shares™ ETFs are advised by Themes Management Company LLC and distributed by ALPS Distributors, Inc.